BharatPe is one of the leading fintech startups in India and has transformed the way small merchants accept digital payments. BharatPe has transformed into a billion-dollar company, but the journey to this success was not simple; it was filled with innovation, controversies, growth and competition.

What is BharatPe?

In 2018, BharatPe was founded by Ashneer Grover and Shashvat Nakrani, revolutionizing financial technology and aimed primarily at serving small merchants and “kirana” store owners. The app offers a wide range of financial services, including QR-based payments, point-of-sale machines, working capital loans, and digital banking solutions through Unit Small Finance Bank.

The BharatPa app allows users a holistic experience by enabling them to accept UPI payments from more than 150 apps using one QR code, making it smooth and cost-effective for small businesses to go digital.

| BharatPe Overview | |

|---|---|

| Category | Details |

| Type of Business | Fintech—Digital Payments & Merchant Banking |

| Founded in | Founded In 2018 |

| Founded by | Ashneer Grover, Shashvat Nakrani, Bhavik Koladiya |

| Chairman | Rajnish Kumar (Former SBI Chairman) |

| CEO | Nalin Negi |

| Net Worth | Approx. USD 2.8 Billion (Company Valuation, 2025) |

| Parent company | Resilient Innovations Pvt. Ltd. |

| URL | https://bharatpe.com |

BharatPe Founder and Current Leadership

BharatPe was originally co-founded by Ashneer Grover and Shashvat Nakrani and was later joined by Bhavik Koladiya. Among these three, Ashneer Grover became the most prominent face of the company, especially after appearing on Shark Tank India Season 1.

In 2022, Ashneer Grover resigned from his post following a controversy with a bank employee, which had a domino effect. Although he denied the authenticity of the clip, it brought in a lot of media scrutiny and influenced the board to launch an independent governance audit, which complicated things and led to Ashneer Grover’s resignation.

Following this, in April 2024, the company elevated Nalin Negi as its CEO, almost 15 months after he took the position of interim CEO.

BharatPe Networth And Valuation

As of 2025, BharatPe’s net worth is estimated at around 2.7 billion; this is based on its last major funding round in May 2025. BharatPe has had a total of 16 funding rounds and has raised around $ 847 million. The company reached unicorn status (valuation of $1 billion) in 2021. The company valuation has seen fluctuations due to internal governance challenges and a very competitive market; however, it has stayed resilient thanks to the diversified offerings and investor confidence.

BharatPe Shareholders and Ownership Structure

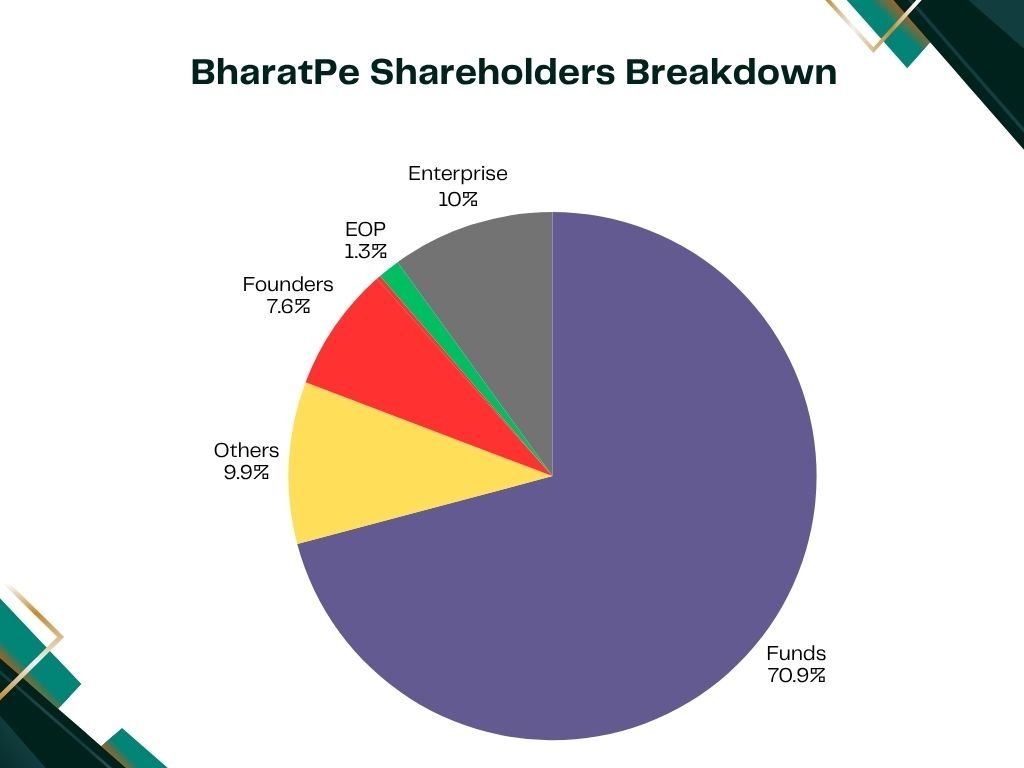

BharatPe’s shareholding structure as of April 2025 shows that the majority of shares are held by Funds, followed by Other People, Enterprise and Founders. A small percentage is held by Angel Investors and ESOPs.

- Funds (70.91%): This category includes institutional investors who have invested in the company over various funding rounds and thus hold the majority of the shares.

- Other People (9.93%): This category involves individual investors and other stakeholders who own the shares in the company.

- Founders (7.64%): This represents the ownership of Ashneer Grover and Shashvat Nakrani, although as of today, Ashneer Grover no longer holds any shares in the company.

- Angel investors (0.26%): These are the early-stage investors who provided BharatPe funding duringthe initial stages.

- ESOPs (1.35%): Employee stock ownership plans allow the company employees to hold shares in the company.

- Enterprise (9.98%): These are various entities related to its business operations.

BharatPe Investors

- The company secured over $847M in a total of 16 rounds of funding.

- The first round was on July 26, 2018, and the latest was a Conventional Debt round on May 7, 2025, for 125 crores, which is approximately around $15M.

- BharatPe is a privately held company, backed by a board of global investors.

- The exact shareholding list is confidential, but key shareholders include Sequoia Capital India, Tiger Global, Beenext, Insight Partners, Ribbit Capital, Dragoneer Investment Group and Coatue Management.

Strategic Acquisition by BharatPe

- BharatPe has pursued acquisitions to strengthen its fintech ecosystem and diversify its services. The most notable acquisition was of ‘Trillion Loans’ in 2023.

- The company acquired a 51% stake in ‘Trillion Loans’, which is a Non-banking Financial Company.

- This acquisition was driven by BharatPe’s aim to address the credit gap between businesses and consumers in India.

- During the time of acquisition, ‘Trillion Loans’ was valued at $100 million. With this, it aims to expand its lending capabilities and provide capital to underserved businesses and consumers

BharatPe Competitors

BharatPe has strong competition in India’s vibrant fintech ecosystem. PhonePe and Google Pay own the UPI payment market with enormous user bases and merchant coverage. Paytm competes with BharatPe on merchant services, digital payments, and lending. Razorpay competes on payment gateways and SME banking, while Pine Labs concentrates on POS and credit products. Even emerging players such as CRED and MobiKwik are venturing into merchant lending and financial services. Unlike consumer-facing apps, BharatPe has a merchant-led strategy, but the war for domination in digital payments and embedded finance makes the competition cutthroat and in a state of continuous flux.

Challenges and Future Outlook

Challenges:

- Due to Ashneer Grover’s controversy, the company has had governance and gone through severe media scrutiny. This makes the governance and leadership more troublesome

- There is intense competition in the field, especially in the digital payment landscape, where larger and better competitors like PhonePe, Google Pay, etc.

- The traditional taboo of digital payments is also another hindrance for fintech companies like BharatPe

Opportunities:

- There is scope for penetration in tier 2 and tier 3 cities, which will revolutionize digital payments for consumers.

- With evolving technology and product innovation in merchant finance, there is immense scope for fintech companies.

- Strategic collaborations with NBFCs ensure a larger consumer base and fulfill the purpose of BharatPe.

Conclusion

BharatPe’s story is one of disruption, scale, and strategic pivots. From pioneering UPI QR codes for merchants to launching a bank, BharatPe has redefined India’s fintech landscape. With strong investors, a growing product suite, and a robust merchant base, it continues to be a fintech brand to watch in 2025 and beyond.

FAQs

BharatPe was founded by Ashneer Grover, Shashvat Nakrani, and Bhavik Koladiya in 2018. Ashneer Grover was the most well-known public face but stepped down from the company in 2022.

As of 2025, the valuation of BharatPe stands at approximately $2.8 billion, after its last substantial funding round in 2021.

Key investors in BharatPe are Tiger Global, Sequoia Capital India, Insight Partners, Ribbit Capital, and Coatue Management.

BharatPe is a fintech firm that offers UPI payments, POS machines, working capital loans, and digital banking to small merchants and Kirana stores across India.

The key competitors of BharatPe include PhonePe, Paytm, Google Pay, Razorpay, and Pine Labs, all of which provide similar payment and financial services.

Disclaimer

This article is purely for informational purposes. All company valuations, net worth, and data are based on public sources as of 2025 and may be subject to changes.