Azad Engineering is an engineering powerhouse in India’s increasing aerospace and defence areas, along with a share price of around Rs 1,391 in January 2026. It has captured the attention of investors in areopspace, defence, energy, oil, and gas sectors. In this blog, we will get to know about the Azad Engineering share price, target, price history, future, factors affecting share price, strength & weakness, and much more.

About Azad Engineering

Azad Engineering before knowing its share price. So, it is a private limited company in Hyderabad, Telangana, on 14 September 1983. It deals in aerospace, defence, energy, oil and gas and power sectors. Its headquarters are located in Hyderabad, Telangana. Azad Engineering supplies to world OEMs such as gas, nuclear, and thermal turbines with 1700 parts and more than 45 processes.

In 2024, the company was listed through a late IPO 2024 which makes it public debut in an increasing defence sector, which was led by Chairman and CEO Rakesh Chopdar and MD Muri Krishna Bhupatiraju. They emphasised on criticsl airfoils and blades. Its growth comes from defence indigenization and energy demand with contracts such as Mitsubishi Heavy Industries Phase 2.

| Metric | Details |

| Founded | 1983 |

| Headquarters | Hyderabad, Telangana |

| Revenue (FY) | Rs 453 Crores |

| Profit (FY) | Rs 89 Crores |

Azad Engineering Share Price History

- IPO Launch: In December 2023, shares began at Rs 524, and during the IPO, it is Rs 677, a fast 29% jump on the first day because of increasing demand.

- Early 2024: The share price was between Rs 670 and Rs 706, which showed slow growth.

- 52 Peak Week: In 2025, the price was at its peak in the 52 weeks. Rs 1899 increased because of orders and company outcomes.

- 52 Bottom Week: Because of the market corrections, the price fall at Rs 1128 to Rs 1159.

- End 2024: In December 2024, the price was Rs 1637 to Rs 172,6 which is a little positive for trading days.

- January 2026: The 1% falls, so Rs 1391 to Ra 1576 is the share price.

| Period | Price Range (Rs) | Key Performance |

| IPO (Dec 2023) | 524 (issue); 677 (list) | 29% listing pop; subscribed 33x. |

| Jan 2024 | 670-706 | Early trading; +0.8% daily avg. |

| 52W High (2025) | 1,899 | Peak on orders/results. |

| 52W Low | 1,128-1,159 | Correction phase. |

| Dec 2024 | 1,637-1,726 | Strong close +0.74% on Dec 24. |

| Jan 2026 (Recent) | 1,391-1,576 | -1% weekly; 1Y +1.8%. |

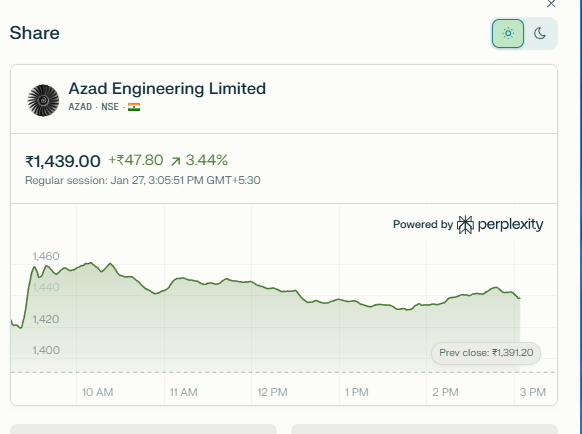

Azad Engineering Share Price (2026)

As of January 2026, the azad engineering share price is given below:

| Date | Open (Rs) | High (Rs) | Low (Rs) | Close (Rs) | Change % |

| Jan 01, 2026 | 1,625.80 | 1,653.00 | 1,622.10 | 1,625.80 | 0.94 |

| Jan 2026 | 1,516.00 | 1,516.00 | 1,464.90 | 1,464.90 | -3.44 |

| Jan 22, 2026 | 1,420 | 1,443.00 | 1,394.20 | 1,406.00 | 0.33 |

| Jan 23, 2026 | 1,408.00 | 1,421.00 | 1,369.70 | 1,391.20 | -1.05 |

| Jan 2026 | 1,402.80 | 1,467.60 | 1,400.50 | 1,438.80 | 3.42 |

Azad Engineering IPO Share Price

| IPO Detail | Details |

| Open Date | December 20, 2023 |

| Close Date | December 22, 2023 |

| Issue Price | Rs 524 per share |

| Price Band | Rs 499 – Rs 524 |

| Listing Date | December 28, 2023 |

| Listing Price | Rs 677 (29% premium over issue) |

| Lot Size | 28 shares |

| Face Value | Rs 2 per share |

| Subscription | 80.65x overall |

| Total Size | Rs 740 Cr (Fresh Rs 240 Cr + OFS Rs 500 Cr)lad |

Factors affecting Azad Engineering Share Price

Given below are some of the factors that influence azad engineering share price, presented in detail:

Huge Orders & Contracts Increased Price: The newest deals, such as Rs 1386 Crores Mitsubishi Heavy Industries contracts, as well as partnerships with Pratt and Whitney, gave transparent future revenue, generating the investors’ confidence.

Powerful Profit & Sales Growth: The company’s profit upto 33% every year for 5 years, with the last quarter’s profit upto 56% to Rs 33 Crores. The stability of 36% showed positive business health, captivating growth buyers.

Government Support: India’s mission of “Make in India” and increasing defence budget favour Azad Aerospace parts. Energy demand for turbines also drives stocks up during the positive Azad Engineering News.

External Risks: The high interest rate, the oil price fluctuations and competition may affect the price because it makes borrowing expensive.

Azad Engineering Share Price Target

| Period | Target Range | Key Driver |

| 2026 | Rs 1,800-2,100 | Q3/Q4 results |

| 2027 | Rs 2,200-2,500 | Capacity expansion |

| 2028+ | Rs 3,000+ | Export growth |

Strengths and Weaknesses: Azad Engineering Share Price

Given below are some of the strengths and risks while investing in the Azad Engineering IPO share price that you should know in detail:

| Aspect | Strengths | Weaknesses |

| Financials | High growth: 33% profit CAGR over 5 years; low debt (0.21 Debt/Equity ratio); healthy cash flow. | High valuation: P/E ratio 79-82 vs. industry avg 46; no dividends despite consistent profits. |

| Operations | Strong OEM partnerships; 1,700+ parts portfolio with 45+ specialised processes. | High working capital strain: Debtors 179 days, inventory 1,097 days, cash conversion cycle 816 days. |

| Market Position | Benefits from defence-sector tailwinds such as Make in India and indigenisation, and a solid order book. | Low ROE: 9% over 3 years; premium P/B ratio 6x signals overvaluation risk. |

| Growth Prospects | 25-30% FY26 revenue guidance; profit growth 33% CAGR supports long-term upside. | Execution risks from competition and sector volatility |

Conclusion

Azad Engineering is a private limited company in Hyderabad, Telangana, established on 14 September 1983, which deals in aerospace, defence, energy, oil and gas and power sectors. The share price was around Rs 1,391 in January 2026. Various factors affect the share market price, such as Huge Orders & Contracts Increased Price, Government Support and such more.

Disclaimer: The above information is only for informational purposes, so not be regarded as financial, investment, or legal advice. The prices may change as per the market. Readers of this blog are advised to always consult a financial advisor before making any investment. The blog and author do not guarantee the accuracy.